does indiana have a inheritance tax

Indiana used to impose an inheritance tax. However other states inheritance laws may apply to you if someone living in a state with an.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Indiana Inheritance and Gift Tax. State inheritance tax rates range from 1 up to 16.

Indiana has no state taxes on. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. This tax ended on December 31 2012.

Inheritance tax was repealed for individuals dying after December 31 2012. The Inheritance tax was repealed. Indiana repealed the inheritance tax in 2013.

Indiana previously had an inheritance tax but it was repealed in 2013. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. There is no federal inheritance tax but there is a federal estate tax.

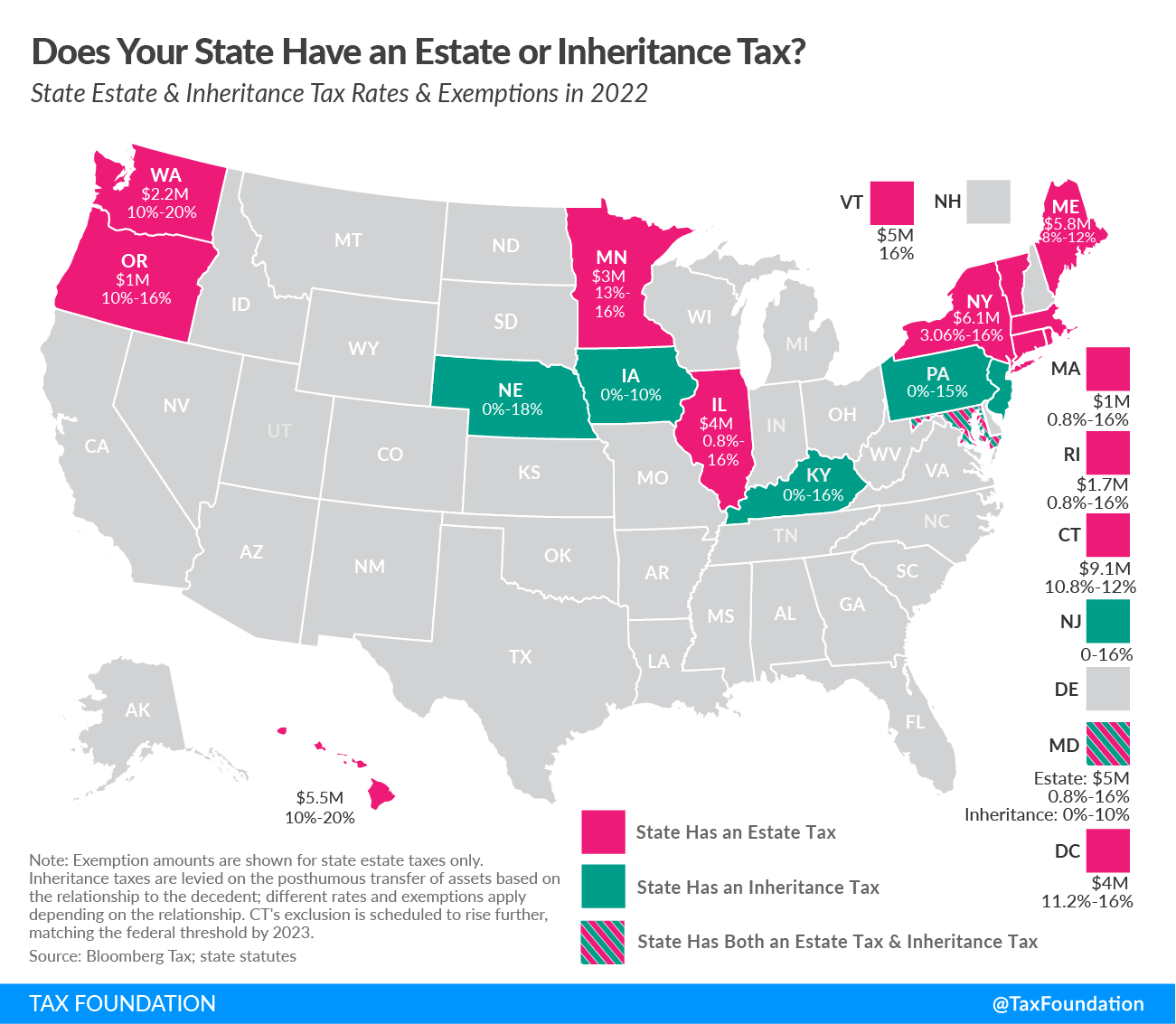

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Indiana does not have its own inheritance or estate taxes. Good news for Hoosiers doing their estate tax planning.

In 2021 the credit will be. How Much Tax Will You Pay in Indiana On 60000. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. For deaths occurring in 2013.

At this point there are only six states that impose state-level inheritance taxes. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12. If you have received an inheritance or know you will be receiving one and live in one.

No inheritance tax has to be paid for individuals dying after December 31 2012. There is no inheritance tax in Indiana either. Indiana does not have an inheritance tax.

Here in Indiana we did have an inheritance. Instead some Indiana residents may have to pay federal estate taxes. Thus there is no Indiana.

Twelve states and Washington DC. Indiana has a three class inheritance tax system and the exemptions and tax rates. Does Indiana have inheritance tax 2021.

On the federal level there is no inheritance tax. Get Help For Your Inheritance Tax. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

Form Ih 6 Indiana Inheritance Tax Return Note Local Courts May Require This Form To Be On Green Paper

Chart Of The Indiana Inheritance Tax Law 1915 Library Of Congress

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

States With No Estate Or Inheritance Taxes

Does Kansas Charge An Inheritance Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance Tax Lpc La Porte County Indiana

How Inheritance Tax Works Howstuffworks

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Is There An Inheritance Tax In Indiana Indianapolis Estate Planning Attorneys

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A